Corporate Transparency Act (CTA)

The Corporate Transparency Act (the "CTA") was enacted by Congress in January 2021 and its primary purpose is to prevent money laundering and other illicit activities by requiring companies formed or registered in the United States to disclose the names of the individuals who own or control the entity. The CTA requires entities to file a beneficial ownership information report with The Financial Crimes Enforcement Network ("FinCEN"), a division of the Treasury Department.

Corporate Transparency Act resources

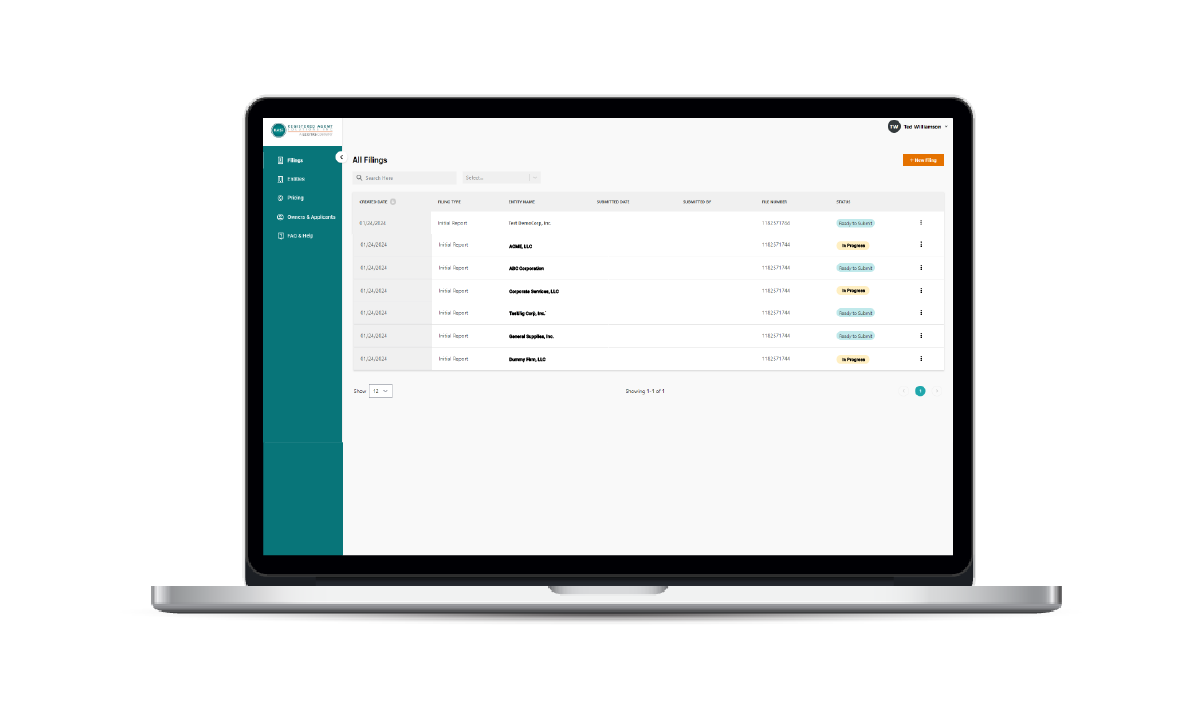

Get started with CTAComply™

The industry-leading solution to your Corporate Transparency Act (CTA) filing needs, CTAComply™ is a highly secure compliance management platform that will allow you to easily comply with the CTA obligations by managing Beneficial Ownership Information (BOI) for your associated companies already housed within our Corpliance® platform.Receive important CTA updates and news

Stay up to date on Corporate Transparency Act (CTA) updates, news alerts, and any recent changes or developments.

Important filing details for the CTA

Which types of companies will have to file a beneficial ownership information report?

There are two types of reporting companies described in the final rule:

- A domestic reporting company is defined as a corporation, LLC or any entity that is created by filing with the Secretary of State or similar office.

- A foreign reporting company is a corporation, LLC or other entity created in a foreign country but registered to do business in the United States by filing with the Secretary of State or similar office.

Are there any exemptions to filing?

The final rule has 23 exemptions - a company that qualifies for an exemption is not considered a reporting company and does not have to file the BOI report.

Among the many exemptions are companies that are already regulated such as publicly traded companies; insurance companies; and broker-dealers. There is also a 'large operating company' exemption which applies to entities that (1) have 20 or more full time employees in the U.S., and (2) filed an income tax return in the previous year with at least $5 million in gross receipts or sales, and (3) have an operating presence or physical office within the U.S.

When do companies have to file?

- Any domestic or foreign reporting company created before January 1, 2024, must file a report no later than March 21, 2025.

- Any domestic or foreign reporting company created on or after January 1, 2024, must file a report within 30 calendar days of receiving notice of their registration or creation.